You can have your own Stripe account now!

We take care of everything for you to have your Business Stripe account live & ready to go in less than 7 days.

Clients

Companies formed

Countries served

Years of experience

Why Privatily?

We understand the challenges you face in accepting card payments at your store, particularly if you are located in a country not supported by Stripe. Our solution is designed to address this issue by managing the entire process for you. We’ll establish a UK or US company on your behalf and set up a fully verified and approved Business Stripe account, no matter where you are in the world. All of this at a highly competitive price!

We accept all countries

Support in 6 Languages

Quick delivery

Trusted by entrepreneurs from 150+ countries

They made setting up my UK LTD a hassle-free experience. The team’s professionalism and prompt responses at every stage ensured a smooth and efficient process.

Mwangi

From Kenya 🇰🇪

Privatily provides excellent customer service. They are always responsive to concerns and keep you updated throughout the process. I was recommended to them by a friend and I highly recommend them to others.

Chinedu

From Nigeria 🇳🇬

I recently used Privatily for my UK LTD formation, and I couldn’t be happier with their service. From the start, the team was incredibly professional and responsive.

Saad

From Morocco 🇲🇦

Basic

$197

and then 59$/yr

If you’re operating with a low budget.

- Your private company in the UK

- Registered office address

- UK business Stripe account consultation

- Certificate of Incorporation

- Company documents delivered to your Email only

- Email support only

Premium

Priority Processing

$297

and then 59$/yr

Enhanced, fast, and exclusive service.

- Everything in Basic, plus:

- Order priority

- Chat and phone support

- FREE UK Phone number

- Dedicated account manager

- Professional company business website that's 100% accepted

- FREE business email inbox

- FREE .com domain

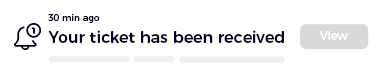

- Wise Business account consultation

- 3 custom logo crafted by our team of skilled Graphic Designers

- Bonuses

Basic

$229

and then 99$/yr

If you’re operating with a low budget.

- US Company Formation

- US Address with Mail forwarding

- Registered agent service

- US business Stripe account consultation

- EIN Number & letter

- Incorporation documents

- Email support only

Premium

Priority Processing

$397

and then 99$/yr

Enhanced, fast, and exclusive service.

- Everything in Basic, plus:

- Order priority

- Chat and phone support

- FREE US Phone number

- Dedicated account manager

- Professional company business website that's 100% accepted

- FREE business email inbox

- FREE .com domain

- Wise Business account consultation

- Mercury Bank Account Consultation

- 3 custom logo crafted by our team of skilled Graphic Designers

- Bonuses

Basic

$247

and then 99$/yr

If you’re operating with a low budget.

- Registration as a Sole Proprietorship

- Business address

- Business Stripe account consultation

- Certificate of Incorporation

- Company documents delivered to your Email only

- Email support only

Premium

Priority Processing

$557

and then 99$/yr

Enhanced, fast, and exclusive service.

- Everything in Basic, plus:

- Order priority

- Registration as Corporation

- Chat and phone support

- Canadian Phone Number

- Dedicated account manager

- Professional company business website that's 100% accepted

- FREE business email inbox

- FREE .com domain

- Bank account consultation

- 3 custom logo crafted by our team of skilled Graphic Designers

- Bonuses

Bonuses for Premium clients only

As a Premium client, we’ll assist you in setting up all the financial services available to you. You’ll have a dedicated account manager and our exceptional support team, ready to assist you via chat, email, and phone.

Our Mission at Privatily

We’re dedicated to helping you increase revenue from your online store. By not accepting card payments, you could be missing out on a significant amount of potential income. That’s why we’re committed to guiding you through the process of becoming legally accepted by major payment gateways, including Stripe.

Frequently asked questions

For the UK:

- Premium orders have a processing speed 3 times faster than Basic orders.

- We typically form companies within just 2 business days.

- Account creation is promptly handled on the same day we receive your company documents.

We need two things from you:

- Either your ID card or passport.

- Your bank statement or a utility bill that includes your name, address and dated within the last 3 months (it should have a date on it so we know when the document was created)

Corporation Tax: All UK Ltd companies are required to pay Corporation Tax on their profits. The rate, as of the last update, is 19%. You need to file a Corporation Tax Return, even if your company doesn’t owe any tax.

VAT (Value Added Tax): If your company’s annual turnover exceeds the VAT threshold (which was £85,000 as of the last update), you must register for VAT. Depending on your business activities, you may charge VAT on goods and services you sell, and you can reclaim VAT you’ve paid on business-related goods and services.

PAYE (Pay As You Earn): If your Ltd company has employees, including you as the director, it should be set up for PAYE. This system collects Income Tax and National Insurance Contributions (NICs) from employees’ wages.

National Insurance: Both the company and employees pay National Insurance contributions. The rates and thresholds depend on the amount of earnings and the specific class of National Insurance.

Dividend Tax: When dividends are issued to shareholders, they might be subject to personal tax, depending on individual circumstances and the amount of the dividend.

Annual Accounts and Confirmation Statement: Every year, your Ltd company must submit annual accounts to Companies House and an annual Confirmation Statement. While these aren’t taxes, they are mandatory reporting obligations.

It’s essential to seek advice from an accountant or tax specialist for detailed guidance tailored to your specific business situation.

Absolutely, except if you’re from Russia.

Short Answer: No.

Detailed Explanation: With our process, you won’t need a VPN. Here’s why:

Your Stripe account will be verified using your actual home address, even if Stripe doesn’t officially support your country. This will be recorded as your ‘home address.’ Simultaneously, the UK address we provide for your company will be registered as your ‘business address.’ Consequently, your Stripe account will feature both addresses: the UK business address and your genuine home address. So, there’s no need for a VPN.

We have answers for so many other questions in our Knowledgebase,

Check our helpdesk articles.

Or you can simply ask our Support team and we’ll be more than happy to help!

Reach Out, We're Here to Help!

Complete the form, and our team will promptly respond to your inquiry within our working hours!

Send us a message