You can have your own US Stripe account now!

We take care of everything for you to have your US Business Stripe account live & ready to go in less than 7 days.

Clients

Companies formed

Countries served

Years of experience

Why Privatily?

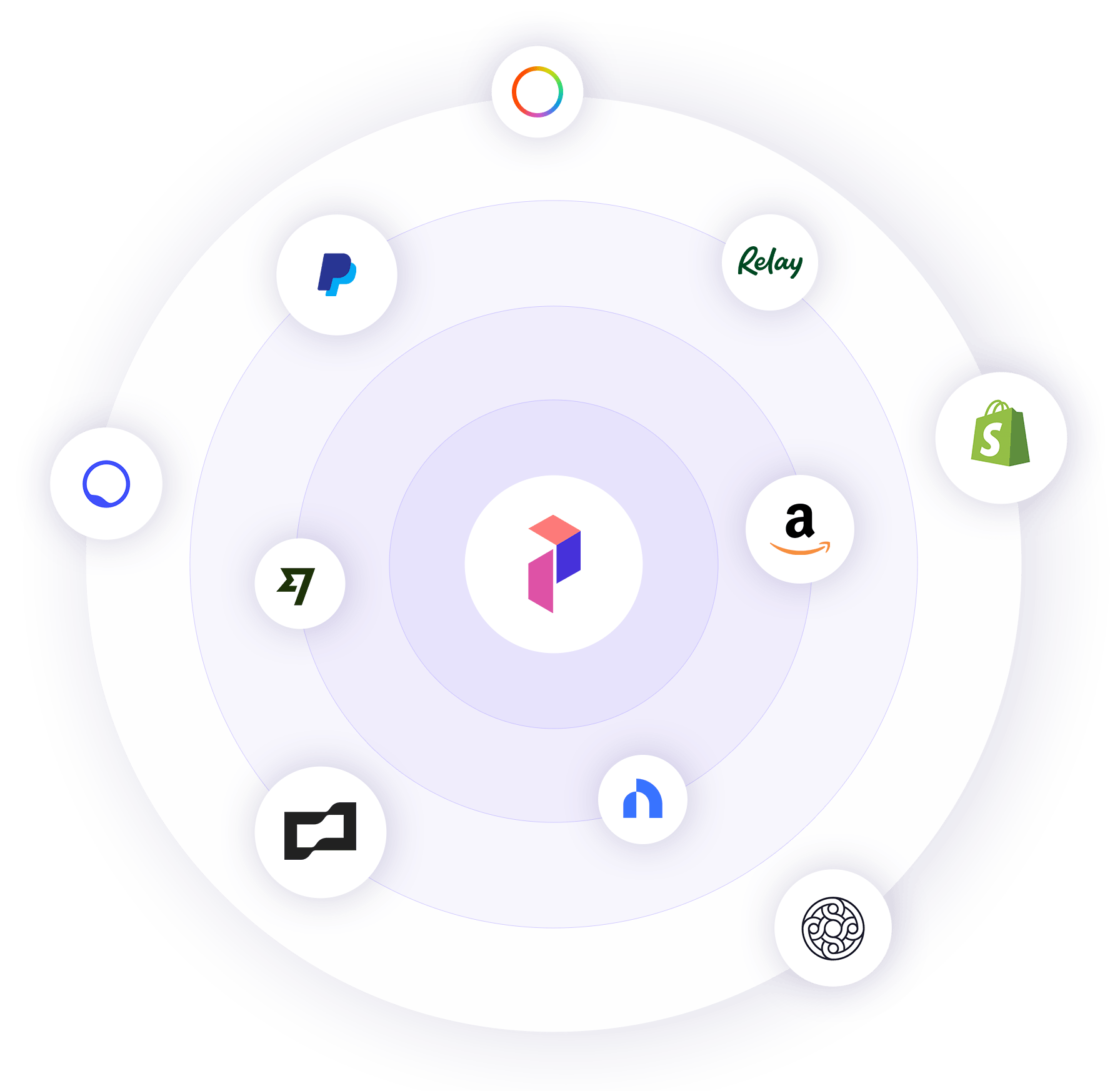

We understand the challenges you face in accepting card payments at your store, particularly if you are located in a country not supported by Stripe. Our solution is designed to address this issue by managing the entire process for you. We’ll establish a US-based company on your behalf and set up a fully verified and approved Business Stripe account, no matter where you are in the world. All of this at a highly competitive price!

We accept all countries

Support in 6 Languages

Quick delivery

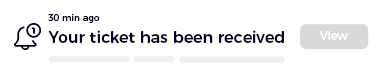

Why Incorporate In The US

Trust

Forming a company in the US is viewed as more trustworthy by financial service providers, like Stripe, PayPal and banks due to the nation’s established business infrastructure and stringent regulatory environment.

Protection

A US-based company provides a legal separation between a business and its owners, known as limited liability protection. This means that in the event of lawsuits or debts, personal assets of the owners are generally protected.

Prestige

A US company can lend prestige and credibility to a business. The US is often seen as a leader in innovation and entrepreneurship, and having a US-based company can enhance the reputation of a business both domestically and internationally.

Trusted by entrepreneurs from 150+ countries

Their speed and prices are unmatched! Starting my business in the U.S. with Privatily was very easy. Their team showed me everything step-by-step, and I can’t thank them enough.

Yusuf

From Pakistan 🇵🇰

Privatily provides excellent customer service. They are always responsive to concerns and keep you updated throughout the process. I was recommended to them by a friend and I highly recommend them to others.

Chinedu

From Nigeria 🇳🇬

I got an outstanding service for my US LLC formation. Their team was not only professional but also highly responsive throughout the entire process, making everything seamless and efficient.

Jamal

From Morocco 🇲🇦

Basic

$229

and then 99$/yr

If you’re operating with a low budget.

- US Company Formation

- US Address with Mail forwarding

- Registered agent service

- US business Stripe account consultation

- EIN Number & letter

- Incorporation documents

- Email support only

Premium

Priority Processing

$397

and then 99$/yr

Enhanced, fast, and exclusive service.

- Everything in Basic, plus:

- Order priority

- Chat and phone support

- FREE US Phone number

- Dedicated account manager

- Professional company business website that's 100% accepted

- FREE business email inbox

- FREE .com domain

- Wise Business account consultation

- Mercury Bank Account Consultation

- 3 custom logo crafted by our team of skilled Graphic Designers

- Bonuses

Basic

$197

and then 59$/yr

If you’re operating with a low budget.

- Your private company in the UK

- Registered office address

- UK business Stripe account consultation

- Certificate of Incorporation

- Company documents delivered to your Email only

- Email support only

Premium

Priority Processing

$297

and then 59$/yr

Enhanced, fast, and exclusive service.

- Everything in Basic, plus:

- Order priority

- Chat and phone support

- FREE UK Phone number

- Dedicated account manager

- Professional company business website that's 100% accepted

- FREE business email inbox

- FREE .com domain

- Wise Business account consultation

- 3 custom logo crafted by our team of skilled Graphic Designers

- Bonuses

Basic

$247

and then 99$/yr

If you’re operating with a low budget.

- Registration as a Sole Proprietorship

- Business address

- Business Stripe account consultation

- Certificate of Incorporation

- Company documents delivered to your Email only

- Email support only

Premium

Priority Processing

$557

and then 99$/yr

Enhanced, fast, and exclusive service.

- Everything in Basic, plus:

- Order priority

- Registration as Corporation

- Chat and phone support

- Canadian Phone Number

- Dedicated account manager

- Professional company business website that's 100% accepted

- FREE business email inbox

- FREE .com domain

- Bank account consultation

- 3 custom logo crafted by our team of skilled Graphic Designers

- Bonuses

Bonuses for Premium clients only

As a Premium client, we’ll assist you in setting up all the financial services available to you. You’ll have a dedicated account manager and our exceptional support team, ready to assist you via chat, email, and phone.

Our Mission at Privatily

We’re dedicated to helping you increase revenue from your online store. By not accepting card payments, you could be missing out on a significant amount of potential income. That’s why we’re committed to guiding you through the process of becoming legally accepted by major payment gateways, including Stripe.

Frequently asked questions

For the US:

- Premium orders have a processing speed 3 times faster than Basic orders.

- We typically form companies within just 2 days.

- Securing the EIN takes an additional 4-7 days (Note: Most other providers require at least 2 weeks for EIN acquisition).

- Account creation is promptly handled on the same day we secure your EIN.

We need two things from you:

- Either your ID card or passport.

- Your bank statement or a utility bill that includes your name, address and dated within the last 3 months (it should have a date on it so we know when the document was created)

Absolutely, let’s break it down step by step:

- Pass-through Taxation: A US LLC is typically considered a “pass-through” entity. This means the company itself doesn’t pay taxes on its income. Instead, the profits (or losses) “pass through” to the owner and are reported on their personal tax forms.

- US Source Income: If your US LLC makes money from selling goods or providing services within the US, you might owe taxes on that income. This can vary depending on the state your company is registered in.

- No US Activities: If your LLC doesn’t do business within the US and you, as the owner, aren’t a US resident, then typically you won’t owe US federal income tax. However, you should always check the local tax rules of the state where your LLC is formed.

- Annual Reports: While this isn’t a tax, many states require LLCs to submit an annual report and pay a fee. This keeps your company in good standing.

- Get Expert Advice: Tax rules can be complex, especially if you’re doing business in multiple countries or states. It’s a smart move to consult with a tax expert who can guide you based on your specific business situation.

Remember, staying informed and compliant is key to ensuring your business runs smoothly!

Absolutely, except if you’re from Russia.

We have answers for so many other questions in our Knowledgebase,

Check our helpdesk articles.

Or you can simply ask our Support team and we’ll be more than happy to help!

Reach Out, We're Here to Help!

Complete the form, and our team will promptly respond to your inquiry within our working hours!

Send us a message